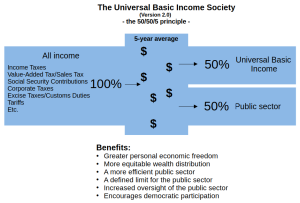

Version 2.0 of The Universal Basic Income Society (UBIS) is based on the 50/50/5 principle. Broadly, this means that all state revenues are distributed such that 50% is paid out as universal basic income and 50% is allocated to the public sector.

Version 2.0 of The Universal Basic Income Society (UBIS) is based on the 50/50/5 principle. Broadly, this means that all state revenues are distributed such that 50% is paid out as universal basic income and 50% is allocated to the public sector.

In more detail, the state’s revenues will consist of taxes, fees, and similar sources. The largest portion of revenue comes from income taxes. Since revenues vary from year to year, a five-year average of incoming funds is calculated. This average serves as the basis for annual allocation, splitting the total evenly: 50% for universal basic income and 50% for the public sector.

The advantage of this model is that every citizen gains greater economic and personal freedom. Additionally, the distribution leads to a fairer allocation of society’s resources. There are also other significant benefits of this model. For example, it promotes efficiency by setting a fixed upper limit on the size of the public sector. Furthermore, the model encourages greater oversight of the state’s use of funds and increased democratic participation, as every citizen has a vested interest in ensuring the public sector operates as efficiently as possible.

The 50/50/5 principle also functions as a common foundation across different ideological perspectives. Whether conservative, social democratic, liberal, or otherwise, governing bodies can still steer society according to their values while reaping all the benefits that Version 2.0 of The Universal Basic Income Society provides.